Within the Urbanize.LA community, many of us admire the contributions new buildings make to the city’s built environment. By providing housing, productive workspaces, public gathering places, or compelling architecture, new buildings can add to our city’s vitality.

Yet for however much buildings can shape their surrounding environments, they are also products of those environments, molded by social, political, and economic forces. This article will focus on one of those critical factors: the economy. It will explore how the city’s economy might evolve over the coming decade, and the impact rapidly growing industries will have on the physical form of the city. In particular, it will focus on four emerging business clusters that will add new dimensions to the city’s geography.

The real estate market is ultimately rooted in background economic activity. The amount of money individuals and businesses make determines how much they are able to spend on all goods, including real estate. When the economy is strong, people have more money in their pockets and can afford to spend more on houses and offices. This has been the case over the past few years, and we’ve seen real estate prices in LA grow at a rapid pace, particularly in areas close to major job centers.

Throughout LA’s history, the form of the city has been shaped to the greatest extent during periods of rapid economic growth. Development projects cluster near the hives of economic activity. At the turn of the twentieth century, Downtown LA was the preeminent jobs center in the region, and streetcar suburbs cropped up surrounding it. By the 1920s, jobs had started moving westward to Hollywood and along Wilshire Boulevard. Residential neighborhoods in the vicinity followed. And as LA suburbanized following from WWII, many neighborhoods were built in proximity to major suburban commercial centers such as Century City, Burbank, or Irvine, to name a few. Today, a series of new business clusters are emerging in the LA region. If history is our guide, we may expect that people working in these new clusters will show a preference for living within a short commuting distance of their jobs, creating ripple effects beyond the immediate vicinities of these job centers.

Economically and culturally, we are witnessing today the maturation and expansion of Silicon Beach, the resurgence of Hollywood (both industry and neighborhood), and the redefinition of Downtown LA, all set against the backdrop of an expanding transit network and increasingly pro-growth public policy. Over the coming decade, these trends will reorient the city around business clusters only hazily defined at this time.

Growth Industries

The local economy is divided into several industry clusters. Though all of these clusters reside in the Los Angeles area, they operate largely independently of one another. They recruit from separate labor pools, they maintain separate institutional affiliations, and they inhabit separate geographic areas of the city. It is valuable to break down our analysis of the local economy into these sectors because some industries are outperforming others. Breaking these sectors down by geography allows us to understand specifically where market demand will likely grow, as opposed to the more general terms through which the local economy is often described.

LA’s most famous industry is entertainment. Its visibility is so great that many observers seem to forget that Los Angeles is home to a range of other important industries as well. Yet, entertainment does play a critical – and growing – role in LA’s economy. The maturation of online streaming technology has led to a boom in demand for video content. Major streaming services such as Netflix, Amazon, and Apple have entered the content creation business, seeking a competitive advantage. All have located their production studios in LA, rather than seeking to recreate Hollywood in their hometowns. Less publicized but similarly impactful has been the location of content creation offices for popular websites such as Buzzfeed and Vox Media in the LA area.

A number of big name tech firms are opening film production centers in Los Angeles, but the more traditional high technology and start-up sector is expanding in its own right. For several years there has been talk of “Silicon Beach”, a local tech cluster centered on the coastal neighborhoods of Santa Monica and Venice. Yet given the relatively small presence of major firms or startups in the area, this moniker was as much an aspiration as a true description.

However, the local technology cluster has matured over recent years. The number and size of local startups are growing. Major tech firms from other cities are opening large LA offices – and not only for media pursuits. A year ago Google occupied just 100,000 square feet of office space in LA – at the “binoculars building” in Venice. It is now expanding that footprint with its 450,000 square foot “Spruce Goose” building in Playa Vista. And in January of 2019, it announced that it will be adding 584,000 square feet of office space at the One Westside project come 2022. Until recently Facebook had leased only 50,000 square feet in LA, but in January it also announced that it would be adding 260,000 square feet to its local footprint in Playa Vista. Apple announced in December of 2018 that it would be opening an office with 1,000 employees in Culver City, in addition to the production studio it had previously planned there. These increases are not incremental; their scale and suddenness point to an inflection point in the growth of LA’s technology economy.

Los Angeles is a relative newcomer in today’s computer tech world, yet for much of the last century is was the global leader in the cutting edge technology of that day: aerospace. Major Cold War defense firms such as Rocketdyne and Northrup were based in LA during that time. The local aerospace industry, particularly in the field of manufacturing, was devastated at the end of the Cold War in 1991. The steroid of defense spending was cut off, and local factories were outcompeted by those elsewhere. Yet aerospace research and development has remained centered in the LA area. It is telling that Elon Musk chose to found SpaceX in Los Angeles rather than in Silicon Valley, where all of his prior ventures are based. Aerospace is not the rocket engine of the local economy like it once was, but it remains a strong sector that continues to grow and incubate technical talent in the region.

The tourism and hospitality sector has also been experiencing rapid growth in Los Angeles. LA County broke the milestone of 50 million visitors for the first time in 2018. Each of these visitors spends money locally on hotels, dining, entertainment, and some of them make lucrative business deals here as well. With 500,000 jobs in the County supported by these industries, they will remain a pillar of the local economy for years to come.

There are a few other major industries that, while not growing as rapidly as those discussed above, provide a stable and diversified backbone for the LA economy. The Ports of Los Angeles and Long Beach combine to form the largest in the country, handling nearly half of America’s international imports. The biotechnology sector remains strong, if not quite as strong as those in other major California cities. And LA’s manufacturing sector remains the largest in the country, despite suffering the same gradual decline familiar across the developed world.

As we look to the future, however, we cannot ignore the possibility that some new industry will have a large presence in Los Angeles. Early indicators suggest LA may become a major center of the emerging transit technology field. Our current mobility system is certainly broken enough to inspire innovative solutions. It was while stuck in the 405 freeway gridlock that Elon Musk first tweeted his idea for the Boring Company, the Hawthorne-based firm that now seeks to build transport tunnels around the world. The three largest companies pursuing Musk’s other concept, hyperloop, are based in LA as well. Prominent startups related to offsite storage and production, such as Clutter or the newest venture of Travis Kalanick (the Uber founder) are also headquartered in the Los Angeles area. Local municipalities such as Culver City are actively exploring innovations in micro-transit. And let us not forget that Bird scooters launched their global conquest from the sidewalks of Santa Monica. Some of these ideas will surely flop, but the foment of such companies in this space taking place here indicates a local ecosystem ripe for innovation of this sort.

There are other emerging industries that may have a bright future in Los Angeles. Speaking with World Trade Center Los Angeles President Stephen Cheung, he sees growth potential in the biotech space – particularly in nanotechnology, given the strong California Nanosystems Institute at UCLA. He also sees growth potential in financial technology, as Los Angeles is home to many smaller community banks, creating an environment well positioned for experimentation in the space. And as the e-sports industry continues to develop, LA’s status as a hub for sports & entertainment alongside the video gaming and technology industries has attracted international investment in the space.

Speaking with Los Angeles Coalition for the Economy & Jobs directors Michael Kelly and Leah Johnson, they see promise in the growth of the ‘blue economy’ – technological advancements in aquatic technology – in Los Angeles. The creation of the AltaSea incubator in this space gives hope for the future of that industry.

Growth Cluster Geography

Each of these industries is associated with defined geographic sections of the city. We cannot learn which neighborhoods will experience the highest growth in demand by looking at the metro area’s overall growth. Complexities are lost at that scale. Zooming in toward the city, we can identify the neighborhoods where these industries are most active. In the areas where the fastest growing industries such as technology and entertainment are based, we can expect to see the largest increases in demand over years to come.

One of the most powerful concepts of urban economics is that of industry clusters. Businesses in the same or related industry, together with their employees, tend to cluster in one geographic area. This is efficient because firms in a particular field often do business with one another. It is sensible for them to be close together, making it easier to collaborate. Firms that service the main companies in an industry also benefit from being near their clients. Employees want a short commute to work, either at their current jobs or at other firms in their same field.

Silicon Valley is an archetypical example of an industry cluster. Startups locate near one another and can thus do business together or with existing tech firms in the area. Local venture capitalists provide them with money, local universities and training facilities provide them with talent, and local catering services provide them with lunch. A skilled software engineer may jump between different tech companies without needing to move homes.

Looking at Los Angeles, there are a number of industry clusters, each occupying its own slice of the city. For example, entertainment is clustered on the Westside, in the Hollywood area, and in the eastern San Fernando Valley. Aerospace is clustered in the South Bay, in the Antelope Valley, and in parts of the San Fernando Valley and Pasadena area. Professional services are clustered in Downtown LA and in certain Westside neighborhoods such as Century City. There are many other such clusters around the region. Given the localized geographic nature of these industries, the impacts of their ups and downs are localized as well. A downturn in aerospace, for instance, might negatively affect property values in aerospace-oriented neighborhoods, but have relatively little effect on entertainment-oriented neighborhoods – and vice versa.

Today we are witnessing the growth of new industry clusters in LA that will have meaningful impacts on the shape of the city over years to come. These new clusters are not replacing the existing ones – as the local economy expands the number of job clusters grows with it. This section will highlight a few industry clusters that are growing at a transformative pace today, and will likely have impacts on their surrounding built environments over decades to come.

Silicon Beach South: Playa Vista, El Segundo, Culver City (southern end), Inglewood

The notion of Los Angeles having a “Silicon Beach” technology cluster, centered on coastal Santa Monica and Venice, has been in common parlance for about a decade. For a period of time, however, high tech in Los Angeles did not extend very far beyond those communities. This has been changing fairly drastically over the past few years. As the technology industry has burgeoned in LA, office space in Santa Monica and Venice is functionally fixed, with very little new supply permitted to be built. Firms have needed to expand their horizons, and many have chosen to seek office space further south down the coast.

Over the past few years many large office complexes have been completed in Playa Vista, located to the south of Venice and Marina del Rey. These have provided major technology corporations such as Google and Facebook with the campus-style offices they prefer, built on footprints they could never find in Santa Monica or Venice.

Moving a bit further south, tech office growth has been very strong in El Segundo, which leverages the legacy of its aerospace industry cluster and its proximity to LAX to support businesses that benefit from those assets. Just to the east, Hawthorne has been burgeoning with the growth of SpaceX.

The southern parts of Culver City are participating in this cluster as well, linked by easy access to Playa Vista along Jefferson Boulevard and to El Segundo along Sepulveda Boulevard and the 405 Freeway. Major firms such as Bytedance and Alexandria Real Estate Equities have recently been making moves in this previously sleepy neighborhood.

In due course, the office facilities being constructed as a part of the City of Champions development in Inglewood may ultimately fall into the same grouping given their proximity to the other neighborhoods that form this cluster.

The Expo Corridor: West LA, Culver City (northern end), West Adams

The Expo Corridor growth cluster roughly follows the path of the Metro Expo Line light rail, which opened in its full length from Downtown LA to Santa Monica in 2015, after reaching only Culver City from Downtown LA in 2012. That extension was critical, as ridership on the Expo Line doubled in about two years after the route to Santa Monica opened. The Expo Line represents a solution for Santa Monica’s overburdened office and residential market, as it extends an economic linkage from that market to places where it is easier to add office or residential supply. Moreover, the roads running parallel to this rail line are frequently choked by traffic, improving its relative speed. The natural value of this connection is supported by the fact that the Expo Line has been the only rail line in LA that continues to grow its passenger numbers, in the face of an overall ridership decline across the region and beyond.

Almost every station along the Expo Line east from Santa Monica to La Cienega is fronted by a major office or residential project. To name a few, 26th Street Station has the Pen Factory office complex; Bundy Station has the Martin Expo Town Center; Sepulveda Station has the 595 unit Linea project; Westwood/Rancho Park Station has the One Westside office project that will serve as a major office for Google in the region; Culver City Station is surrounded by major projects on all sides (including the future homes of Apple Studios and Amazon Studios); and the La Cienega/Jefferson Station is abutted by the 1,210 unit Cumulus project and the architecturally innovative office tower called (W)rapper.

Perhaps more important over the long run, however, are the zoning changes to these neighborhoods surrounding these stations. City programs such as Transit Oriented Communities or the Expo Corridor Transit Neighborhood Plan allow for greater density in these areas. Ultimately State-level actions such as the currently proposed SB 50 may allow for even greater density near transit or job centers. The subsequent wave of small developments would be the truly transformative agent along the Expo Line.

In certain respects, the forces driving growth along the Expo Corridor are similar to those driving growth in Silicon Beach South: office and residential supply in the tech hubs of Santa Monica and Venice are effectively fixed, while demand continues to grow. Demand is spilling southward along the coast; it is also spilling eastward along the Expo Line and the parallel 10 freeway.

But the Expo Corridor has some advantages that Silicon Beach South lacks. Its central location within the region allows for easy access to the beach communities, but also to the greater Hollywood area, and to Downtown LA to the east via the 10 freeway or the Expo Line itself. Moreover, the Expo Line train (and parallel bicycle path) allows for relatively easy movement within this cluster. An April 2018 study by RCLCO indicates that new residential projects built with superior access to mass transit and bicycle sharing mobility options command higher rental rates. These forms of transit are well provided for within the Expo Corridor, and their value will grow as more jobs and residences are created along the train line.

Hollywood

Hollywood is increasingly the home of Hollywood. Of course the eponymous entertainment industry has some of its earliest roots in the neighborhood Hollywood, but in the decades following from WWII that industry suburbanized as did many others in Los Angeles. Studios and affiliated offices dispersed to the Westside and to the eastern San Fernando Valley, with Paramount Pictures being the only major firm maintaining its primary studio in Hollywood proper.

In recent years this trend has begun to reverse. The cultural epicenter of the city has migrated eastward as the Westside has become unaffordable and as young people desire more urban lifestyles, making neighborhoods such as Los Feliz, Silver Lake, and Hollywood more desirable to entertainment industry employees. Entertainment-associated jobs have followed.

Further, in a fashion similar to the tech industry, studios on the Westside found that they had difficulty expanding there given ironclad opposition to growth. And as traffic in LA has progressively worsened, the commute between entertainment clusters on the Westside and the eastern Valley has become more arduous. The neighborhood of Hollywood offers a viable middle-ground between those two industry nodes.

But the key event in Hollywood’s revival has been the frantic expansion of Netflix. Since signing on at Hudson Pacific Properties’ ICON tower in Hollywood in 2015, Netflix has gone on a production tear in the neighborhood. It has invested billions of dollars in original content, itself shifting the center of gravity for production in the direction of Hollywood.

Sources familiar with the thinking of Apple, Amazon, and HBO in wanting to locate studios in Culver City indicate that these companies are making this decision in large part due to Netflix’s pull in Hollywood. These companies were having difficulty getting some industry contractors to do work at their west-of-the-405 offices, because they were too far from same-day work at Netflix in Hollywood.

With Netflix set to expand in Hollywood from about 400,000 square feet of office space today to 1 million square feet by 2022, we may anticipate the pull of this neighborhood to grow stronger. This is particularly true if other production firms expand their own Hollywood presence, adding to the local cluster.

Downtown Los Angeles

Of all of LA’s growth stories over recent decades, perhaps none has been as dramatic as Downtown LA’s. Its explosive growth, a topic I wrote on at length in the “L.A. Urbanized” series released last year, has been most dramatic in the residential and cultural fields. Its resident population has quadrupled from about 20,000 at the turn of the century to about 80,000 today – with about â of all new housing in the City over that course of time being built in Downtown. In that same time period, it has also emerged as one of the main lifestyle centers of the region. But in terms of its status as a business and employment center, results thus far have been mixed. Despite all other areas of growth, employment count and office vacancy rates Downtown are similar today to what they were at the outset of the neighborhood’s resurgence.

Dig a bit deeper, however, and we can see that the office environment Downtown is in a state of flux. The absolute numbers regarding workers and office space Downtown have been steady, but their compositions have not. Over recent years Downtown’s traditional tenants – the big banks, law offices, and professional services firms – have become more efficient due to technological advancement and do not require as much space as they once did. This has led to downward pressure on the Downtown office market.

Meanwhile, new industries have been taking root Downtown which previously had little presence there. The most notable new industry Downtown over the past 20 years is architecture, civil engineering, and land use planning. In a familiar story, many firms in this industry have decamped from their previous homes in places such as Santa Monica and Venice due to prohibitive costs and commute times for workers. Downtown LA offers these firms cheaper rent and access to a talent shed that draws from a much larger segment of the city. Moreover, by being Downtown these firms are closer to the local government with which they often interact, and also to many of their projects. Some of the most notable firms in the region, including Gensler, Arup, and HR&A, have made this move.

The impact of these firms moving Downtown bolsters the local business agglomeration, but this particular cluster is discussed here primarily to illustrate the potential for entirely new industry clusters to take root Downtown (or in other neighborhoods). The Downtown office market 10 years from now may not look much like it does today. Indeed, a recent report released by the Downtown Center Business Improvement District (DCBID) indicates that over 40 percent of prospective tenants exploring the DTLA office market are from creative industries.

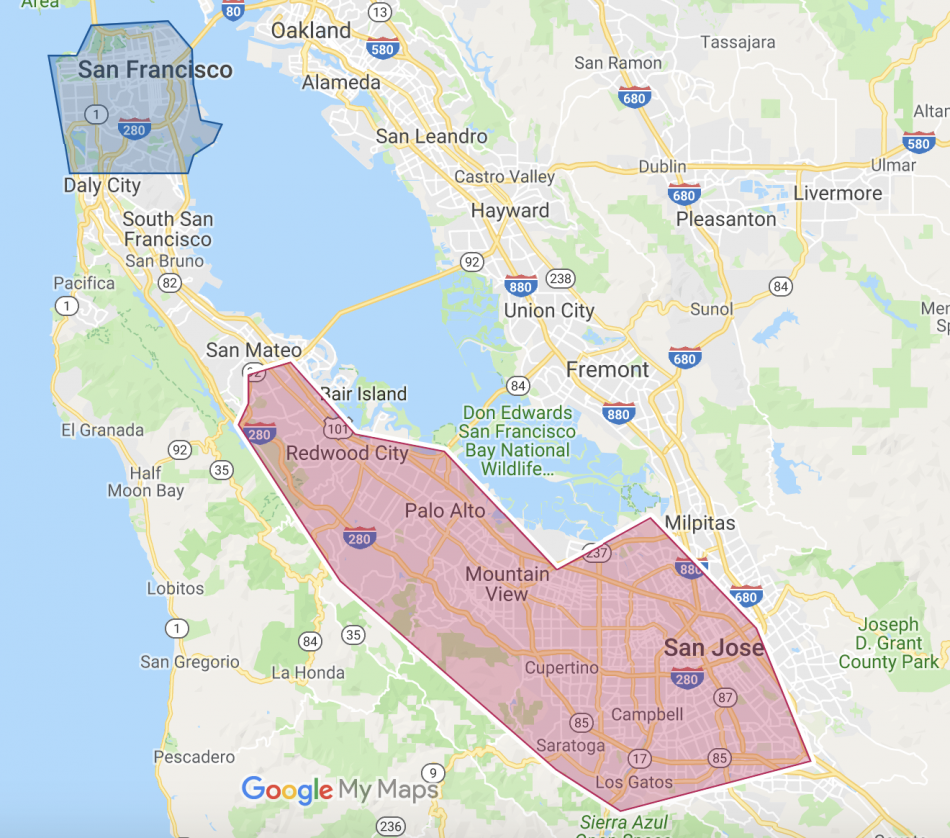

If creative economy firms begin moving in greater force to Downtown LA, such a move would not be without precedent. Over the past 10 years the tech industry’s center of gravity in the Bay Area has shifted northward from suburban Silicon Valley to urban San Francisco. Silicon Valley used to attract businesses with its relatively inexpensive corporate office parks and its proximity to executives’ houses. Yet over the past few years, Silicon Valley real estate has grown much more expensive, and more technology employees have shown a preference to live in San Francisco for lifestyle reasons.

San Francisco was long the home of more traditional industries such as finance and law, yet in recent years technology firms have opened there en masse. A few early entrants were enticed by the City of San Francisco with tax breaks, but for most these were not the main consideration. Being in the city has not just put them closer to where their employees want to live, but it has also provided enhanced access to the more traditional businesses based in SF. As Silicon Valley land values continue to rise, it isn’t a bad bargain on office rent either.

The relationship between Downtown LA and the Westside is in some respects similar to that between San Francisco and Silicon Valley, albeit with the clock wound back a few years in LA. The travel times between the two pairs are comparable, and in both cases the suburban locales were initially considered more desirable by tech firms. The local technology cluster is rapidly growing on the Westside, including in some new neighborhoods such as Playa Vista, El Segundo, and along the Expo Line corridor. But given restrictive land use policies in all of those places, available office and residential space is liable to fill up quickly. As the industry continues to grow, and as more young people flock to the more easterly reaches of the city such as Downtown, Koreatown, and the Eastside, the local tech industry may find that it is easier to shift its growth Downtown than to seek further expansion in the restrictionist Westside.

Conclusion

When people are trying to identify which neighborhoods will experience increased demand over years to come, they often look for the trendy shops and buzzy cafes. Hipsters certainly find these amenities desirable. But perhaps these sorts of venues are the symptoms of growing market demand as often as they are the cause. People spend much of their waking time at work, and attach a high value to avoiding long commutes. When the locations of jobs change, the areas in easy commuting range move with them. This article has identified four emerging job clusters in the Los Angeles area: Silicon Beach South, the Expo Corridor, Hollywood, and Downtown LA. The effects of job growth will be felt most strongly within those cluster areas. But the impact of these centers’ emergences will be felt beyond, reorienting some of the region’s housing market over the decade to come.

Jason Lopata works as a land use consultant with Craig Lawson & Co., LLC, helping real estate development projects in LA navigate the city approvals process. Jason previously spent time on the Business Team of LA Mayor Eric Garcetti. He also writes articles on globalization and urban development for Stratfor, the geopolitical analysis website. Jason received his bachelor’s degree from Stanford University and completed programs of study at the University of Oxford and at UCLA’s Anderson School of Management. While at Stanford, he founded and led the student real estate organization, and authored his senior thesis on Los Angeles development over the past 30 years.